By Andressa Lima (UFPA / CFC-GS)

Climate finance is one of the key instruments to enable the transition to a low-carbon and climate-resilient economy. Since the signing of the Paris Agreement in 2015, the mobilization of financial resources has become a central theme at the Conferences of the Parties (COPs), which year after year seek to align global commitments to reduce emissions with the need to provide developing countries with the means to implement their goals. In this context, Brazil holds a strategic position: it is a country of great biodiversity, with vast natural resources and a decisive role in combating deforestation and preserving the Amazon, factors that place it at the center of international negotiations.

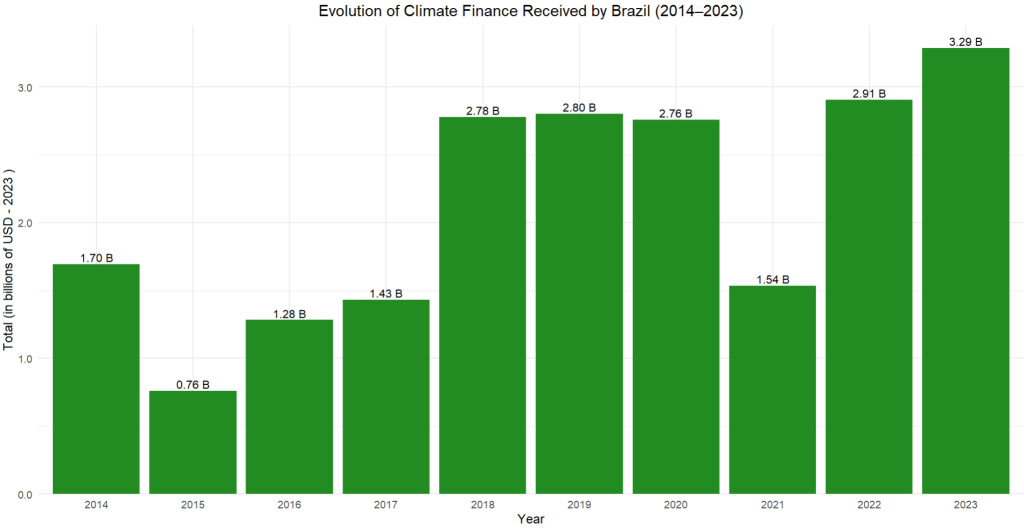

Between 2014 and 2023, Brazil experienced a trajectory marked by advances and setbacks in climate finance, reflecting both internal changes and the dynamics of global negotiations. The period reveals significant fluctuations in the volume of resources received, as well as changes in allocation profiles and financial instruments used. Analyzing this trajectory is essential not only to understand the paths already taken but also to anticipate the challenges and opportunities that lie ahead for the country at a time when the international climate agenda is gaining even more relevance, especially with COP30 to be held in Belém, in the heart of the Amazon, in 2025.

Compiled by the author based on OECD CRS – Climate‑related Development Finance. Available in the CFC‑GS Climate Finance Tracker.

During this period, Brazil went through distinct phases in accessing climate resources. In 2014, the volume received was US$ 1.7 billion, but it dropped sharply the following year to just US$ 760 million. From 2016 onwards, a recovery began, reaching around US$ 2.8 billion in 2018 and 2019, values that remained stable until 2020. In 2021, there was another drop to US$ 1.54 billion, but from then on there was a vigorous rebound, culminating in 2023 with a record US$ 3.29 billion. This trajectory shows that, although subject to oscillations, the general trend was one of growth, with a recent strengthening of climate finance in the country.

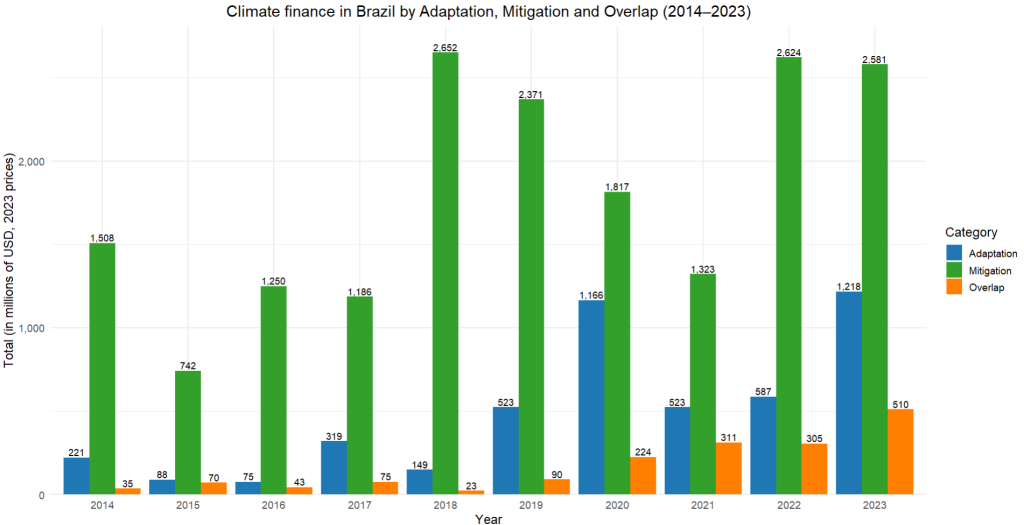

Compiled by the author based on OECD CRS – Climate‑related Development Finance. Available in the CFC‑GS Climate Finance Tracker.

When analyzing how resources were allocated, there is a clear predominance of mitigation, aimed mainly at reducing emissions. In 2018, 2022, and 2023, this category exceeded US$ 2.5 billion, consolidating itself as the priority of funders. Adaptation, although less expressive, gained importance from 2017 onwards, with highlights in 2020 and 2023, when it surpassed US$ 1.1 billion, signaling greater recognition of Brazil’s vulnerability to extreme climate events. Meanwhile, resources classified as overlap — combining adaptation and mitigation — remained at lower levels but grew consistently, reaching US$ 510 million in 2023. These figures show that, while mitigation remains central, there is a growing diversification of finance towards climate resilience.

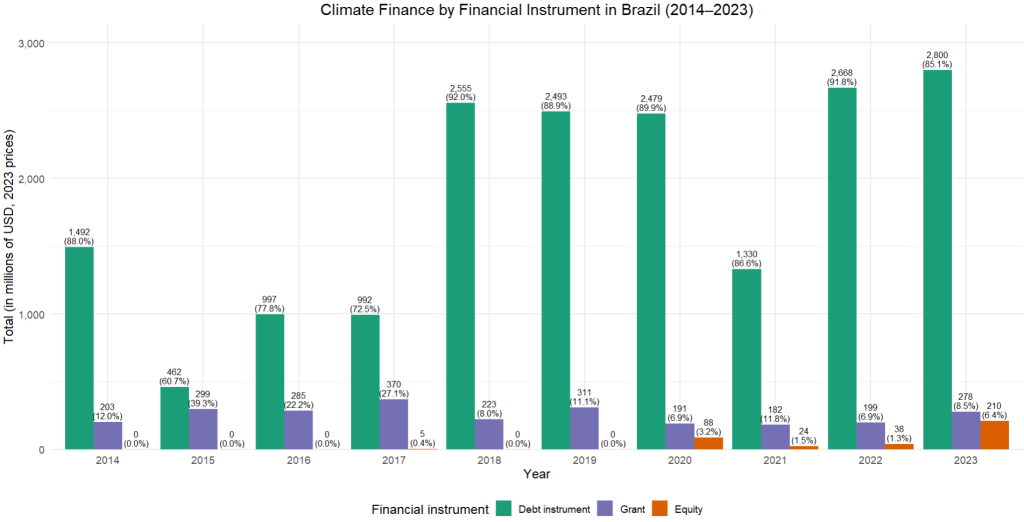

Compiled by the author based on OECD CRS – Climate‑related Development Finance. Available in the CFC‑GS Climate Finance Tracker.

In terms of financial instruments, Brazil relies predominantly on Debt instruments, which accounted for more than 85% of the total in most of the series, reaching 92% in 2018. This pattern indicates that climate finance in the country occurs mainly through debt, which limits investment flexibility. Grants, which had some relative importance in 2014, 2015, and 2017, lost ground and remained residual in the following years. From 2020 onwards, Equity financing also appeared, still modest, but pointing to a trend of greater private sector engagement. This predominance of Debt instruments suggests the need to seek a better balance among mechanisms, in order to reduce dependence on credit and stimulate more innovative and inclusive approaches.

The analysis of the 2014–2023 period shows that Brazil significantly expanded the amounts received in climate finance, consolidating itself as one of the main destinations among developing countries. However, the profile of these resources still brings important challenges: dependence on Debt instruments, the concentration on mitigation to the detriment of adaptation, and the low share of Grants. The future of climate finance in Brazil will depend not only on increasing volumes but also on diversifying sources and instruments, and on the ability to align investments with the country’s social, environmental, and economic needs.

This trajectory is especially relevant in view of COP30, which will take place in Belém, in the heart of the Amazon, in 2025. The event will place Brazil at the center of international climate negotiations and bring with it the expectation of greater leadership in defining rules and accessing finance. The recent history highlights progress but also reveals gaps that must be addressed: how to attract more Grants, how to strengthen adaptation mechanisms given the Amazon’s vulnerability, and how to ensure that climate finance reaches states and municipalities. COP30 will therefore be a unique opportunity for Brazil to show the world not only its strategic importance but also its ability to lead by example, articulating economic growth, social justice, and environmental protection in a long-term trajectory.