Douglas Alencar (UFPA/CFC-GS) and Andressa Lima (UFPA/CFC-GS)

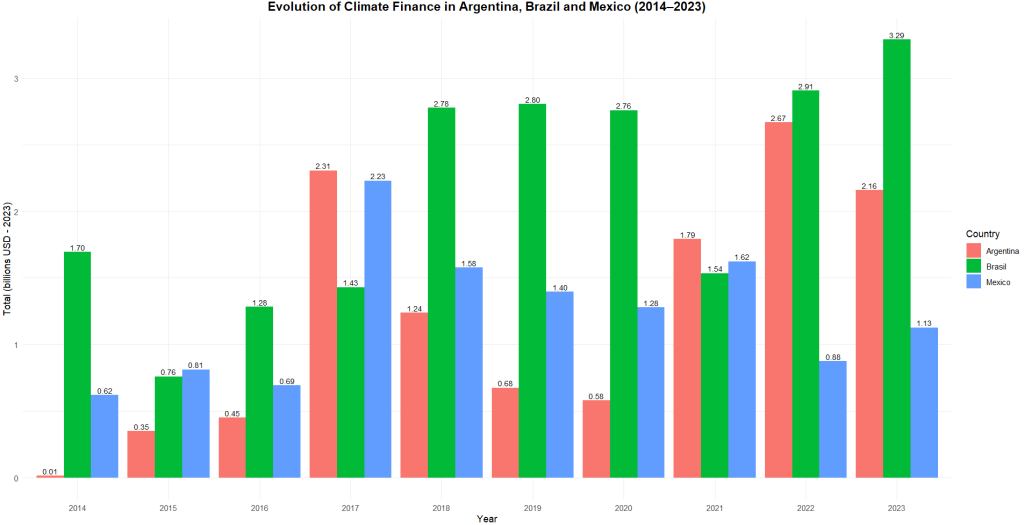

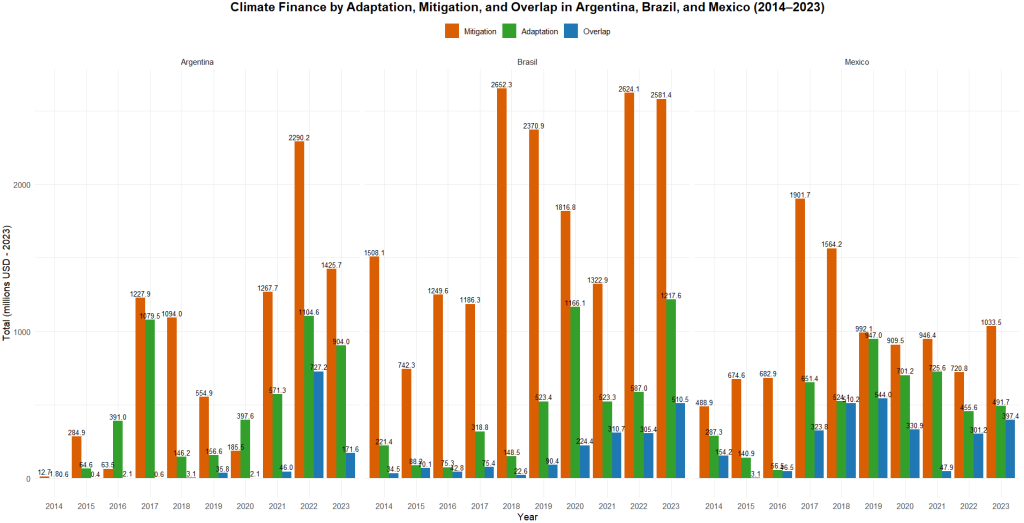

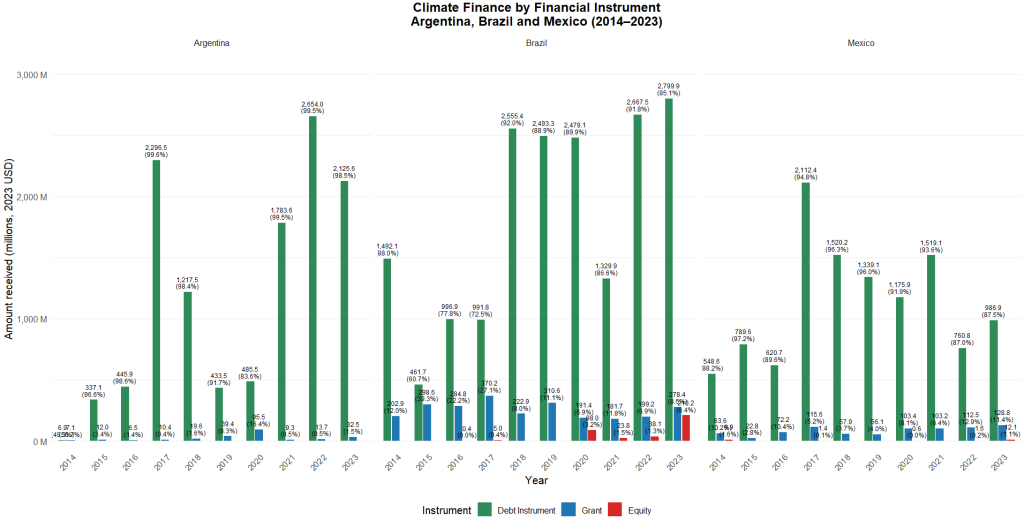

Climate finance in Latin America has followed distinct trajectories in Argentina, Brazil, and Mexico over the past decade. Data from 2014 to 2023 reveal not only differences in volume, but also in the composition and allocation of resources. Brazil has consolidated its position as the largest recipient, with consistently higher values and peaks in years such as 2018, 2019, and 2023. Argentina, in turn, experienced significant expansion beginning in 2017, standing out in 2022 and 2023, while Mexico maintained more moderate levels, with notable performance only until 2017, followed by relative stagnation. Beyond total volume, mitigation accounts for the largest share of flows in all three countries, with adaptation playing a more significant role particularly in Mexico, while overlapping objectives remain less relevant. In terms of instruments, loans dominate the structure of climate finance, representing the vast majority of resources received in the three countries, while grants and equity contributions play a marginal role. Taken together, the figures highlight a common pattern of strong reliance on loans directed toward mitigation, while also revealing important differences in the capacity to attract resources and in the pace of climate finance expansion across Argentina, Brazil, and Mexico.

Compiled by the author based on OECD CRS – Climate‑related Development Finance. Available in the CFC‑GS Climate Finance Tracker.

The chart shows the evolution of climate finance in Argentina, Brazil, and Mexico between 2014 and 2023, expressed in annual values (billions of USD, in 2023 prices). Brazil (in green) consistently leads throughout most of the period, reaching peaks in 2018 (2.78 billion), 2019 (2.60 billion), and 2023 (3.29 billion). Argentina (in red) displays a more irregular trajectory but records strong expansion from 2017 onward, with notable peaks in 2022 (2.67 billion) and 2023 (2.16 billion). Mexico (in blue), in contrast, maintained more stable levels, generally lower than the other two countries, ranging from 0.62 billion (2014) to 2.23 billion (2017), before declining after that peak. Overall, the chart highlights Brazil’s greater capacity to attract climate resources, Argentina’s recent progress, and Mexico’s relative stagnation after 2017.

Compiled by the author based on OECD CRS – Climate‑related Development Finance. Available in the CFC‑GS Climate Finance Tracker.

The chart presents the evolution of climate finance allocated to mitigation, adaptation, and overlap in Argentina, Brazil, and Mexico from 2014 to 2023 (in millions of USD, at 2023 prices). It is evident that mitigation (orange bars) overwhelmingly dominates the flows across all countries and years, particularly in Brazil, which recorded high values, with peaks above 2.6 billion in 2017 and 2019. Argentina also experienced strong growth in mitigation-focused finance starting in 2021, reaching over 2.2 billion in 2022. In Mexico, although at a lower level, financing remained more balanced between mitigation and adaptation, with notable figures in 2017 (1.9 billion for mitigation and 561 million for adaptation). Adaptation finance (green) is more prominent in Mexico, while in Brazil and Argentina it maintains a smaller share. The overlap category (blue), encompassing projects with both mitigation and adaptation components, is less significant but gains relevance in specific years, particularly in Mexico. Overall, the chart highlights that the climate agenda in the region remains strongly oriented toward mitigation, with recent advances in adaptation in Mexico and occasional increases in overlap.

Compiled by the author based on OECD CRS – Climate‑related Development Finance. Available in the CFC‑GS Climate Finance Tracker.

The chart shows climate finance by type of instrument (loans, grants, and equity) received by Argentina, Brazil, and Mexico between 2014 and 2023 (in millions of USD, at 2023 prices). It can be observed that in all three countries, loans (in green) overwhelmingly dominate, almost always accounting for more than 80% of the annual total. Brazil stands out with high volumes of loans, exceeding 2.5 billion in several years, such as 2017, 2019, and 2023. Argentina also exhibits a strong concentration in this instrument, particularly in 2017 (2.2 billion) and 2022 (2.0 billion). Mexico, although at lower levels, follows the same trend, with notable figures in 2017 (2.1 billion). Grants (in blue) appear more prominently at certain points, especially in Argentina and Mexico, but in amounts much smaller than loans. The equity category (in red) is almost negligible, appearing only occasionally, such as in Brazil in 2023. In summary, the chart highlights the three countries’ reliance on loans as the primary mechanism for climate finance, with grants and equity playing a secondary role.

Based on the analyzed data, it can be concluded that climate finance in Argentina, Brazil, and Mexico follows a pattern of strong concentration in loans and mitigation-focused projects, reflecting both international priorities and the region’s structural limitations in diversifying instruments and expanding adaptation initiatives. While Brazil stands out for the largest absolute volume and Argentina has shown significant growth in recent years, Mexico demonstrates greater stability and relative diversification. These results suggest that, despite progress, the three countries still face common challenges: reducing dependence on credit, increasing the role of grants and equity, and strengthening policies that balance mitigation and adaptation, in order to align climate finance with long-term socio-environmental needs.